HSN Search Made Easy: Locate Codes for Every Product Category

HSN codes, or Harmonized System of Nomenclature codes, are used to classify products for taxation and regulatory purposes. Each product is assigned a specific code, making it easier for businesses, sellers, and buyers to identify items accurately. Understanding HSN search codes is essential for compliance with tax laws and smooth business operations.

The Importance of HSN Codes

HSN codes simplify trade by providing a universal system for categorizing products. They help in calculating GST accurately, reduce errors in billing, and ensure proper reporting to tax authorities. Businesses of all sizes benefit from using HSN codes to streamline accounting and avoid legal complications.

How to Search for HSN Codes

Locating HSN codes can be simple if you know where to look. Many online platforms and government portals allow users to search by product name, category, or description. Accurate search ensures that the correct code is used for every product, which is crucial for taxation and documentation purposes.

Tips for Accurate HSN Code Identification

When searching for HSN codes, clarity in product description is key. Using precise terms and knowing the category of the product helps narrow down the results. Consulting official sources or verified databases ensures that the code you select is valid and compliant with current regulations.

Benefits of Using HSN Codes Correctly

Correctly using HSN codes reduces errors in invoices, ensures smooth tax filing, and avoids penalties. It also improves communication between suppliers, buyers, and government authorities by providing a standardized reference for every product.

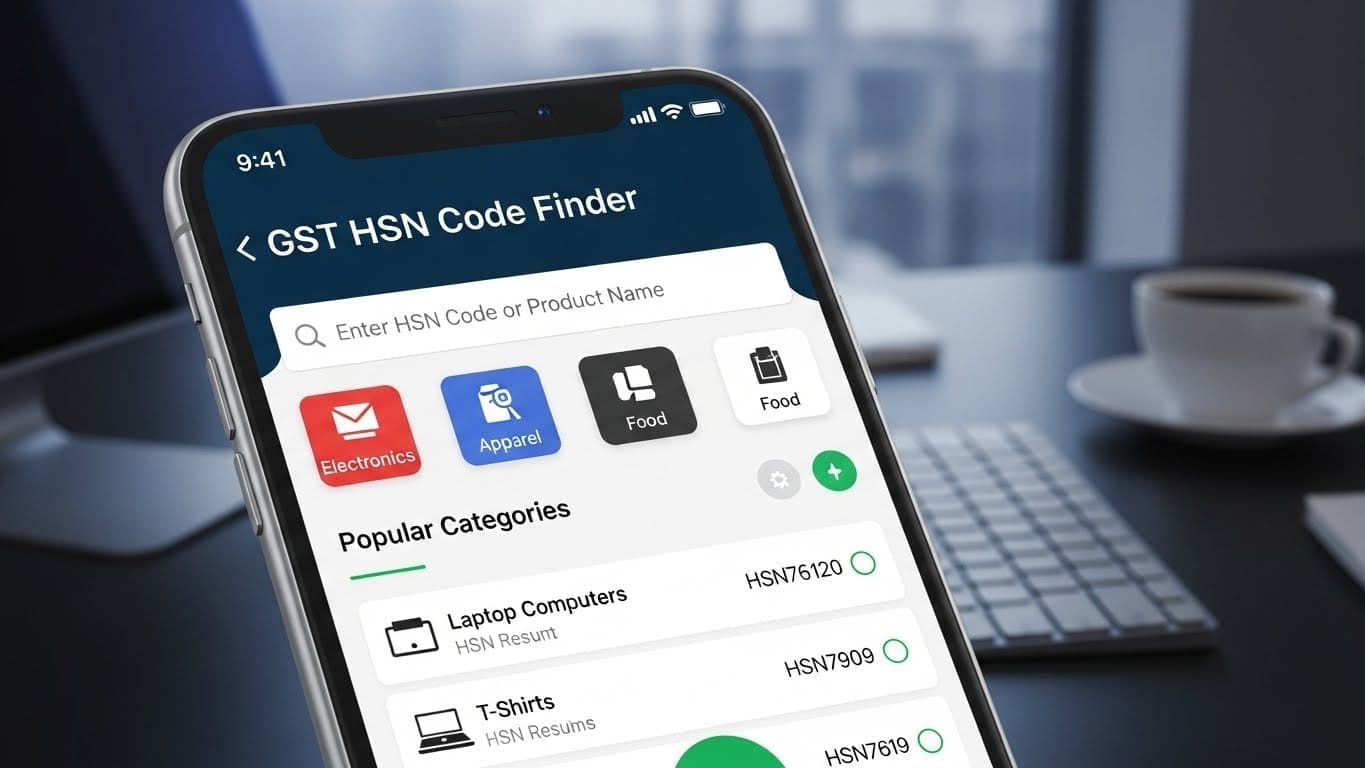

Tools and Resources for HSN Search

Several tools make HSN search easier, including online government portals, mobile apps, and dedicated websites. These resources allow users to quickly locate codes for thousands of product categories, making business operations faster and more efficient.

HSN Codes and GST Compliance

HSN codes are directly linked to GST rates. Accurate classification ensures that the correct tax rate is applied, preventing discrepancies during audits or tax filing. Businesses that stay updated with HSN codes can maintain compliance and avoid unnecessary issues with authorities.

Making HSN Search Part of Business Workflow

Integrating HSN code searches into daily business activities, such as inventory management and invoicing, saves time and reduces errors. It also helps in reporting and record-keeping, making operations more organized and professional.

Why HSN Search Matters

Efficient HSN search is not just about compliance; it supports smooth business processes and helps maintain credibility with customers and authorities. Proper classification ensures accurate taxation, better management, and smoother transactions.

Conclusion

HSN search made easy allows businesses to quickly locate the correct codes for every product category. By using official resources, following best practices, and understanding the importance of HSN codes, businesses can stay compliant, improve efficiency, and simplify tax management for long-term success.

Created with © systeme.io